How to get 10x the value from your points

Hi! I'm Shrey, and I'm a software engineer turned travel advisor. Back in March 2020, the travel bug bit me hard at probably the worst possible time. While the rest of the world was in quarantine picking up new hobbies, baking sourdough, and doing TikTok dances, I spent all my free time reading about the one thing I couldn’t do at the time: travel.

Over the past two years, I've traveled hundreds of thousands of miles and redeemed tens of thousands of dollars in free travel. There’s a pervasive myth that traveling the world on points requires seven-figure spending or constantly hopping coast to coast for some big consulting firm. That hasn’t been my experience: I rarely traveled for work as an engineer and I’d like to think I spend frugally, yet I’ve learned to make these credit card and frequent flyer programs work for me.

There’s no shortage of travel hacking content online, but points are a chaotic, complex web of unintuitive axioms and odd stipulations. I’ve always found that you can’t actually get anywhere without reading dozens of articles, and even then, it feels like you’re trying to clear a forest with a butter knife. In this Substack, my goal is to cut through the noise and clear the path for you. You’ll learn hacks that you can apply today, and hopefully over time, you’ll also develop an intuition for hacking on your own too.

Today we’re tackling transfer partners, one of the most important and high impact topics that will show you the path to doing tons of free flights. I imagine people are at very different levels of familiarity with transfer partners, so if you’re new, keep reading, and if you’re a seasoned veteran, feel free to scroll down a bit unless you want a refresher!

For beginners: Why do Transfer Partners matter?

If you’ve seen people zipping around on free business class flights, chances are they’re not just secretly point millionaires. Instead, they’re stretching their credit card points by transferring them into specific airline frequent flyer programs.

The major credit card programs for travel are Amex, Chase, Citi, Capital One, and Bilt — I’ll call these the Big 5. Most travelers know that the Big 5 programs each have a travel portal where you can easily redeem your points on flights. The catch is this usually involves spending your points at a fixed rate of 1-1.5¢/point. That means if you want a $1000 flight, you’re could be burning as much as 100k points — that’s more than most credit card sign up bonuses, just for one flight!

What savvy travelers know is the Big 5 also allow you to transfer your points to specific frequent flyer partners, and this is the key to unlocking their true value. This is because unlike the Big 5 travel portals, most frequent flyer programs don’t set a fixed exchange rate. This means your points could be worth way more when you transfer! You can routinely find redemptions of 2-3¢/point, and if you’re really skilled or lucky, I’ve seen killer redemptions as high as 12¢/point! That same $1000 flight could cost you as little as 8k points — you might earn that in just a single month of smart spending.

I could probably write a PhD thesis on transfer partners, but for now I’ll try and give you my best 10 minutes on the topic.

Rules of the Game

Getting high redemptions doesn’t come for free, and it does involve a bit of a learning curve. First, a few ground rules for working with points:

Transfers are one way. Once you transfer points from a credit card program to a frequent flyer program, you can’t go back. Only transfer if (a) you have a redemption in mind and are about to book or (b) there’s a great transfer bonus (we’ll talk about this in future issues).

You can’t just transfer to any program. Each of the big 5 credit card programs partners with specific frequent flyer programs. This is why it’s best to own cards across various programs.

You usually can’t transfer points across frequent flyer programs. For example, a mile in United MileagePlus usually can’t be transferred to Air Canada Aeroplan. (There are a few limited exceptions, but I’ll cover those in future issues.)

Transfers are usually 1:1 but not always. For example, you can convert 1 Chase point into 1 United mile. While the majority of transfer partners for the Big 5 are 1:1, some have slightly unequal ratios like 1:2 or 2:1.5 for some of the less commonly used partners.

A motivating example: Let’s go to London in the spring!

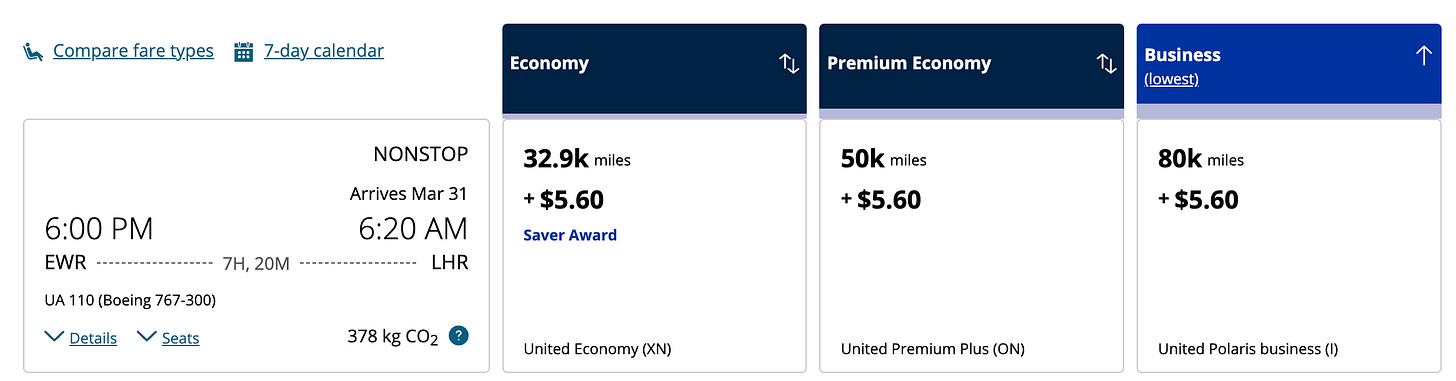

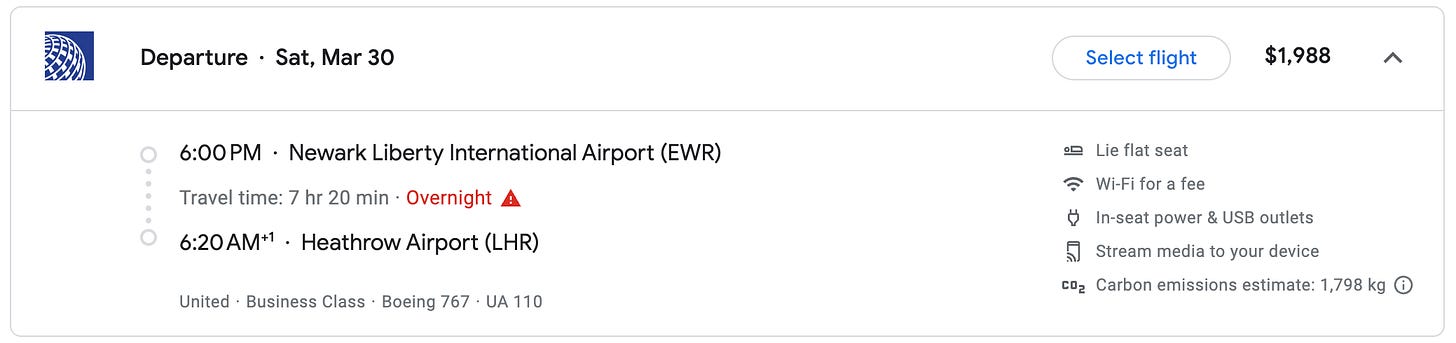

Now for some examples! Let’s say you want to take advantage of the shoulder season for London in April — it’s starting to warm up but you’re not paying peak season prices. If you have a Chase Sapphire or Bilt card, you can transfer your credit card points to United MileagePlus and book a United Polaris business class flight departing March 30th from EWR to LHR for 80k miles.

The actual flight would cost $1988 if we bought outright in cash according to Google Flights:

That means we’re redeeming our points at a rate of roughly 2.48¢/point!

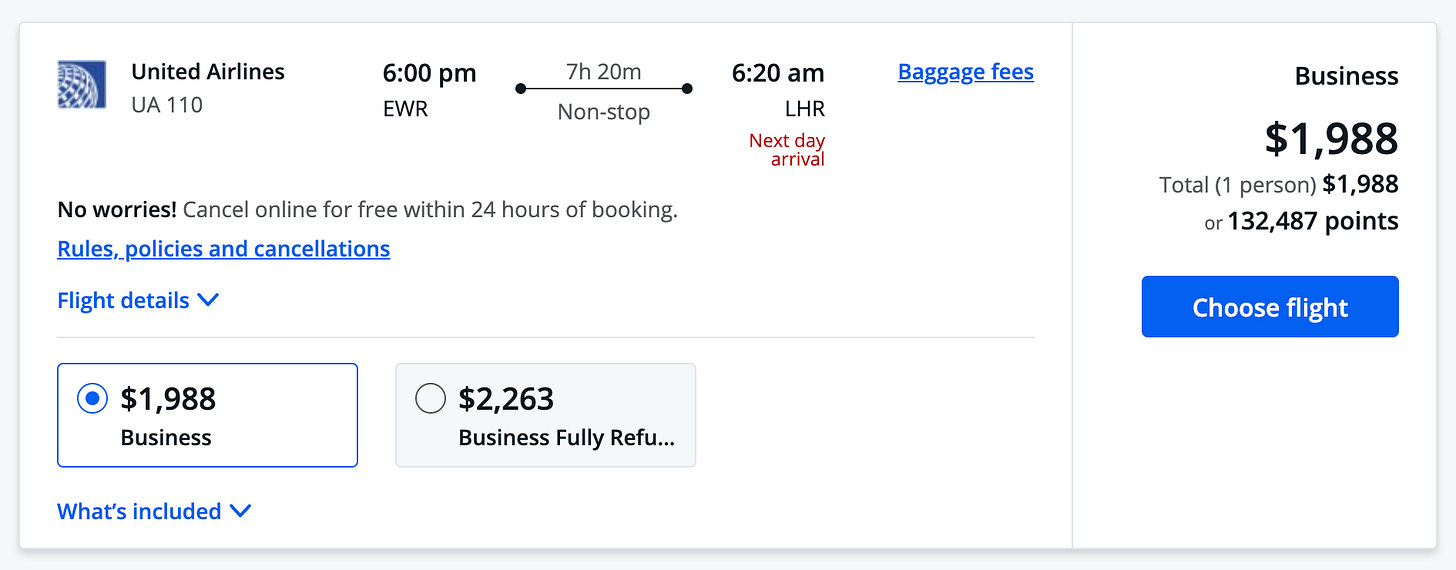

Compare this the quote of 132487 points we get from the Chase portal:

Since I have the Chase Sapphire Reserve, my Chase points redeem at a fixed rate of 1.5¢/point in their portal (a signature benefit of that card), but just by transferring into United instead, I squeeze out 65% more value from my points!

If you want to go far, go together: The magic of airline alliances

As I mentioned earlier, each of the Big 5 programs has a designated list of transfer partners. Here’s the list for Bilt for example:

It’s perfectly normal to look at this list and think “I’ve never heard of half of these airlines, let alone flown them.” But you don’t actually need to fly these airlines to get tremendous value out of their frequent flyer programs.

Let me explain. Most airlines are part of a major airline alliance. You’ve probably heard of them:

Star Alliance (cofounded by United)

Skyteam (cofounded by Delta)

Oneworld (cofounded by American)

When an airline join an alliance, they agree to allow other airlines in the alliance sell tickets on their flights, and in return they get to sell tickets on their partners flights. When you go on the United website and you see an option to buy a ticket that’s actually operated by Turkish Airlines, that’s why — both of them are in Star Alliance.

Fortunately for us, this cross-selling phenomenon isn’t just limited to tickets bought in cash (“revenue tickets”, in point hacker parlance). It also applies to tickets bought on points (“award tickets”)! In other words, Turkish Airlines can let members of their frequent flyer program, Miles&Smiles, book award tickets on United flights using their Turkish Airlines miles. Similarly, United MileagePlus members can often book Turkish Airlines flights using their United miles.

This opens up a whole glorious world of possibilities and points arbitrage. Each frequent flyer program uses a different method to calculate how many points a given flight should cost. Some look at the flight distance, some look at which regions the flight transits between, and others look at how much demand exists for that seat. This means you can sometimes find the exact same flight and cabin for fewer points in a partner program!

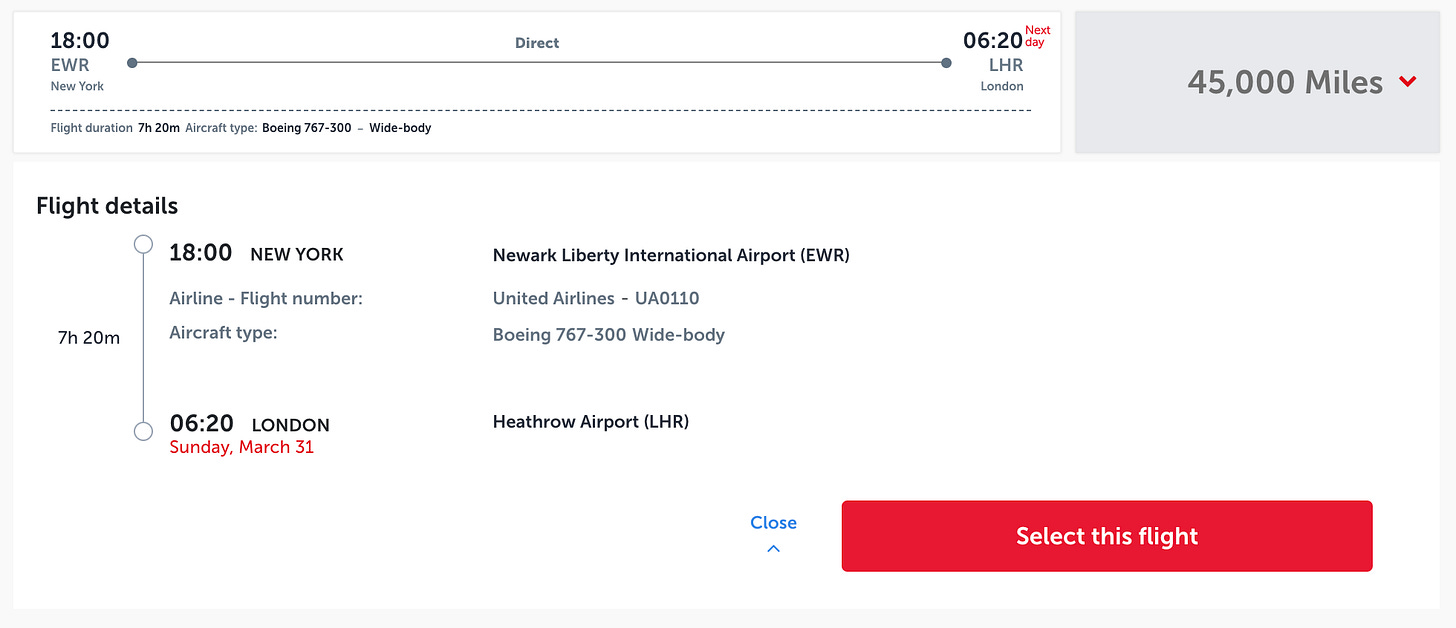

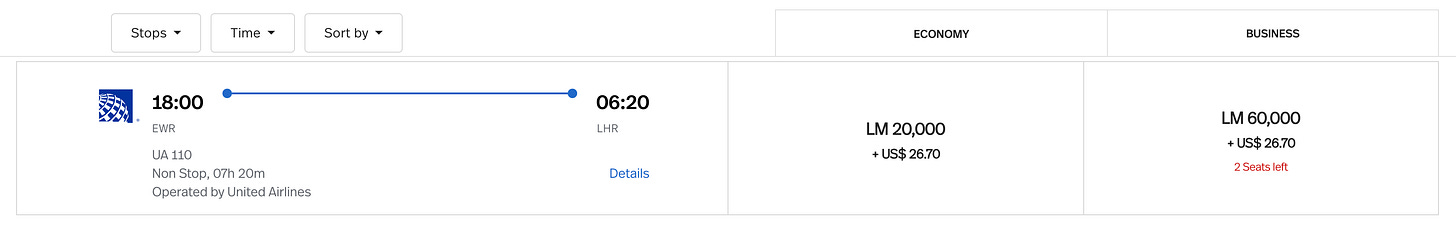

So let’s go back to our example: EWR-LHR in business class on flight UA 110. If we check the Turkish Airlines award search, we can find that same exact seat for just 45k Turkish miles. That’s a whopping 4.97¢/point!

If you’ll recall, this same flight would have cost 80k United miles or just above 130k Chase points — we’ve literally gotten 2-3x the value just by going through a United partner.

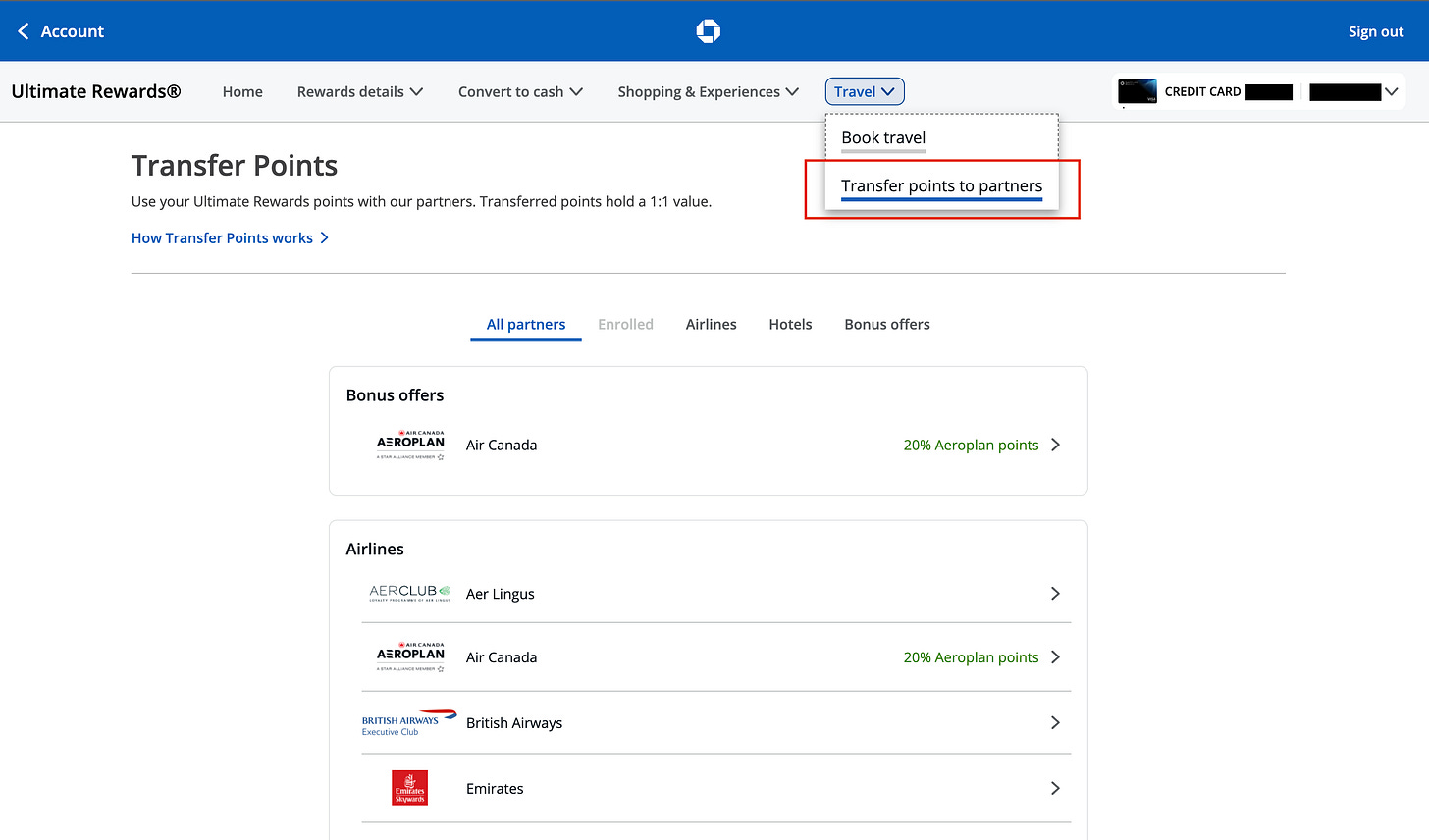

You may think “but wait, I don’t have any Turkish miles.” But if you have a Bilt card (or selected Citi or Capital One cards), your credit card points can transfer at a 1:1 ratio into Turkish Airlines Miles&Smiles. This is why these transferrable points programs are so powerful: you can use them to book flights in programs you don’t regular use.

Now let’s say you only have an Amex. You wouldn’t be able to transfer to Turkish Airlines unfortunately, but there’s still a deal for you! Chances are you’ve never flown or even heard of Avianca, but all you need to know is they’re a Star Alliance partner too. And that same EWR-LHR United business class seat is still available for 60k Avianca Lifemiles. Not as amazing as the Turkish redemption, but still a nice discount from the United MileagePlus one!

(As you can see, it does pay to have exposure to various Big 5 programs so you can always get the optimal redemption.)

Knowing how alliances work can lead to tremendous savings and help us easily maximize our points. It’s not always easy to find these redemptions though, and exploring the whole web of airlines alliances can get complicated. That’s why point hacking is a skill, and it definitely takes practice to get better at it! In the “Advanced” section below, I share a few tips for finding these redemptions, and I’ll share more in future issues too.

By the way, that March 30th EWR-LHR flight I’ve been using as my example? That’s a real flight with actual award availability as of 6am this morning. Good points deals often get snapped up fast, so take a look if you’re interested!

Some notes on redemption rates

Typically you’ll see the really mouthwatering redemptions (>= 5¢/pt) on premium cabins. However, you can still find nice economy redemptions at a rate of 2-3¢/pt! For instance, our example EWR-LHR flight costs $460 for economy and is also available for 20k Avianca Lifemiles; that’s 2.3¢/pt.

I’ve talked a lot about how you can get > 1¢/point by transferring points. But since the redemption rate isn’t fixed in most frequent flyer programs, the opposite can also be true. Sometimes you may see terrible redemptions of 0.5¢/point, in which case you need to look elsewhere, book via the credit card portal, or maybe even just book on cash.

How do I actually transfer points?

Usually you can transfer points in your credit card’s rewards portal. Look for words like “transfer to partners”. From here, you’ll be asked to link your frequent flyer account — ensure that you’re entering your member number accurately! Once you’ve done that, you’ll be able to transfer points, usually in increments of 1000 points.

For most partners, the transfer is nearly instant. Go make a coffee and your freshly transferred miles should be deposited in your frequent flyer account by the time you’re back. On some occasions though, the transfer can take longer. This can be a bit inconvenient if you’re booking a particularly popular award ticket that may run out of space; I’ll talk about how to get around this in a future issue.

Does this mean I should never use my points my credit card’s travel portal?

Nope! If you’re trying to save cash, ultimately free travel is free travel. You might not be maximizing your points, but that might not be what matters then. However, be careful not to exhaust all your points in the portal; missing a killer partner redemption because you’re out of points is quite painful.

Many portals also offer a combo of cash + points payment option. This can help take the edge off a particularly pricey flight by letting you, in effect, set your own preferred discount using points. I recently did this for a last-minute domestic flight; flights were $200 more than usual, so I used 13,000 points to offset the increase. Additionally, by using the Chase portal with my Chase Sapphire Reserve, my points were valued 50% higher (1.5¢/pt), and I earned 5x points on the cash portion— not bad!

For experts: Two of my favorite underrated transfer partners

As experts, you’ve probably used your fair share of transfer partners and gotten some awesome redemptions. There’s a few programs I don’t think get enough love, and I figure I’d talk about them below and exactly how you can add them to your repertoire.

Types of award space

(For some of you, this may be review; I just want to make sure we have a shared vocabulary here!)

Not all award space is created equally. Usually when an airlines releases award tickets for a given flight, they release it into 4 buckets:

Airline saver space

Non-saver space

Partner saver space

Airline saver space is a special promotional rate offered for award tickets. If you can snag one of these rates, you know you’re getting the best points rate that program can offer. Often airlines will have a fixed rate for saver space (e.g. “one way US-Europe economy = 20k”), but unfortunately many US-based airlines have dynamic rates even for saver space. There’s very limited seats available in this bucket, and once it’s exhausted, you’re just left with non-saver space.

Non-saver space is usually much pricier (think ~2x the cost), and is more likely to be dynamically priced based on demand (read: you’re not gonna get a stellar redemption rate here). Non-saver space can still be worth booking though if the cash fare for the flight is super expensive.

Finally the partner saver space bucket is similar to airline saver space, but allocated for the airlines’ partners instead. The partner program is allowed to choose whatever pricing strategy they want for these seats, and often, the best deals come from partners that price their partner saver space cheaper than the airlines’ own saver space. One catch: the amount of partner saver seats is less than the amount of airline saver space, so if you find one, you better book fast.

Turkish Airlines Miles&Smiles for domestic coast-to-coast trips on United

The Sweet Spot

Yes, weirdly enough the cheapest way to fly across the USA on points is through a non-US based airline! The Miles&Smiles program uses a region-based award chart where the point cost of a flight depends on your start and end region. Generally most programs using such charts tend to split the US into an East and a West region, which bumps up the cost of flying cross country. Fortunately, Turkish Airlines has a sweet spot here: flights within a single country count as flying within a single region, regardless of the size of the country. If we reference their award charts, we can see the saver (“promotional”) award ticket rate for domestic/intracountry flights is just:

Economy one way for 7.5k miles

Business one way for 12.5k miles

(Turkish is in Star Alliance, so these flights are actually just United flights being cross-sold by Turkish.)

This is such a ridiculously low cost award that has managed to stay under the radar for quite a while now. But there’s a good reason for that: for the longest time, the only way to transfer to Turkish was through Citi or Capital One, which aren’t as popular. But that’s all changed with the Bilt card; it’s one of the fastest growing cards in America, and they have recently become the 3rd transfer partner for Turkish. Now these deals are way more accessible to travelers!

Finding Award Availability

Unlike other airlines, Turkish Airlines unfortunately doesn’t let you see a calendar of available dates, which makes finding award availability hard. However, we can use a little trick: we can use a different Star Alliance partner with a better award search tool to find the available dates, and then pop those dates into the Turkish award search and book from there. This works because all Star Alliance partners will have access to the same partner saver space; it’s just a matter of finding it.

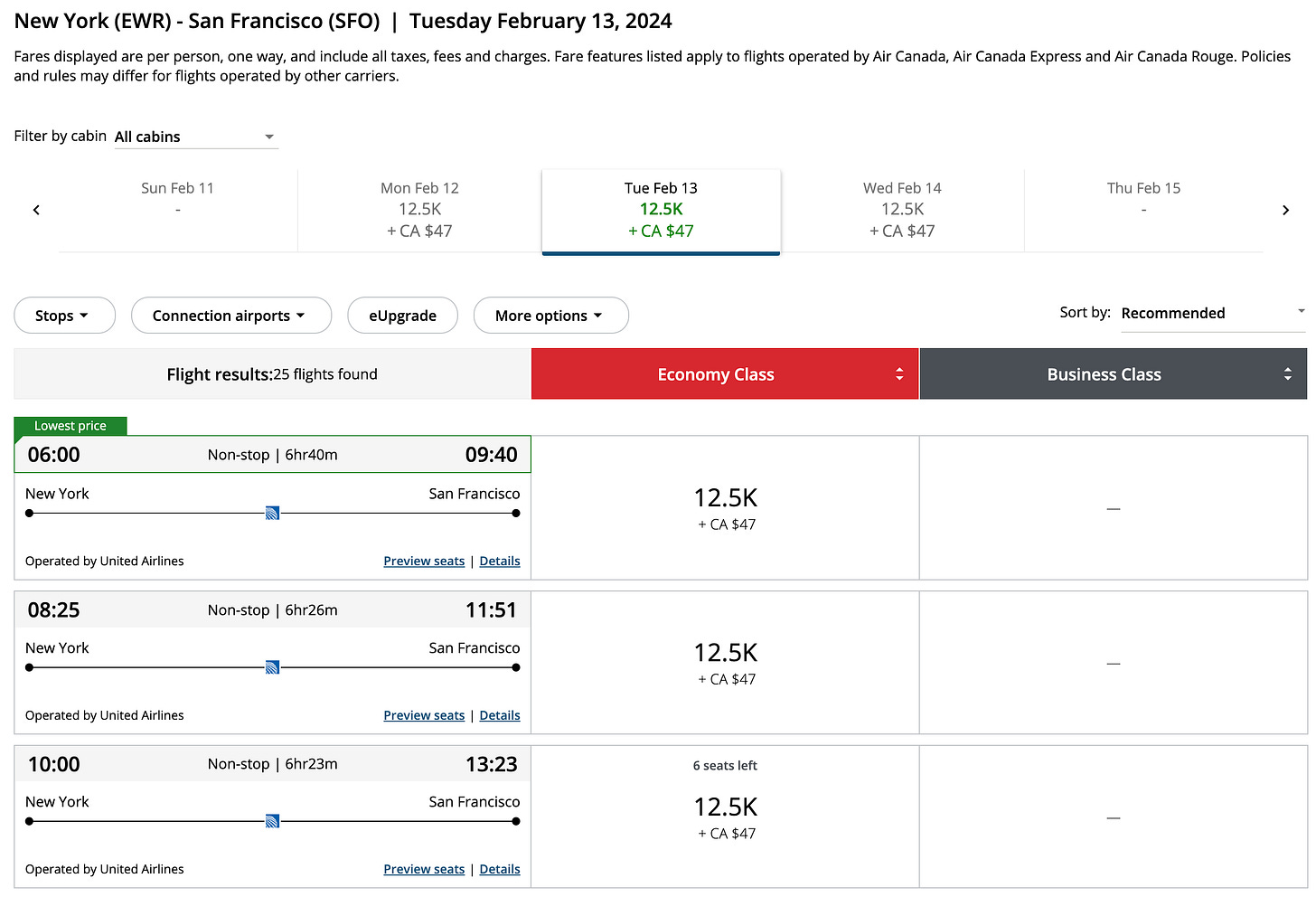

Air Canada Aeroplan is known for having a really great award search tool for Star Alliance partner space, so we can just pop in our origin + destination city here and some rough idea of a date we want to travel on. Once you sign into your Aeroplan account, you’ll be able to see a 5 day availability calendar at the top. Generally you’re looking for anything that is priced low (like 15k miles or less), and on United metal — chances are that’s partner saver space.

Let’s look for NYC > SFO for Feb 13 (perfect V-Day timing for all the cross-country long distance couples!).

According to the calendar at the top, we could also book on Feb 12 or Feb 14, but not Feb 11.

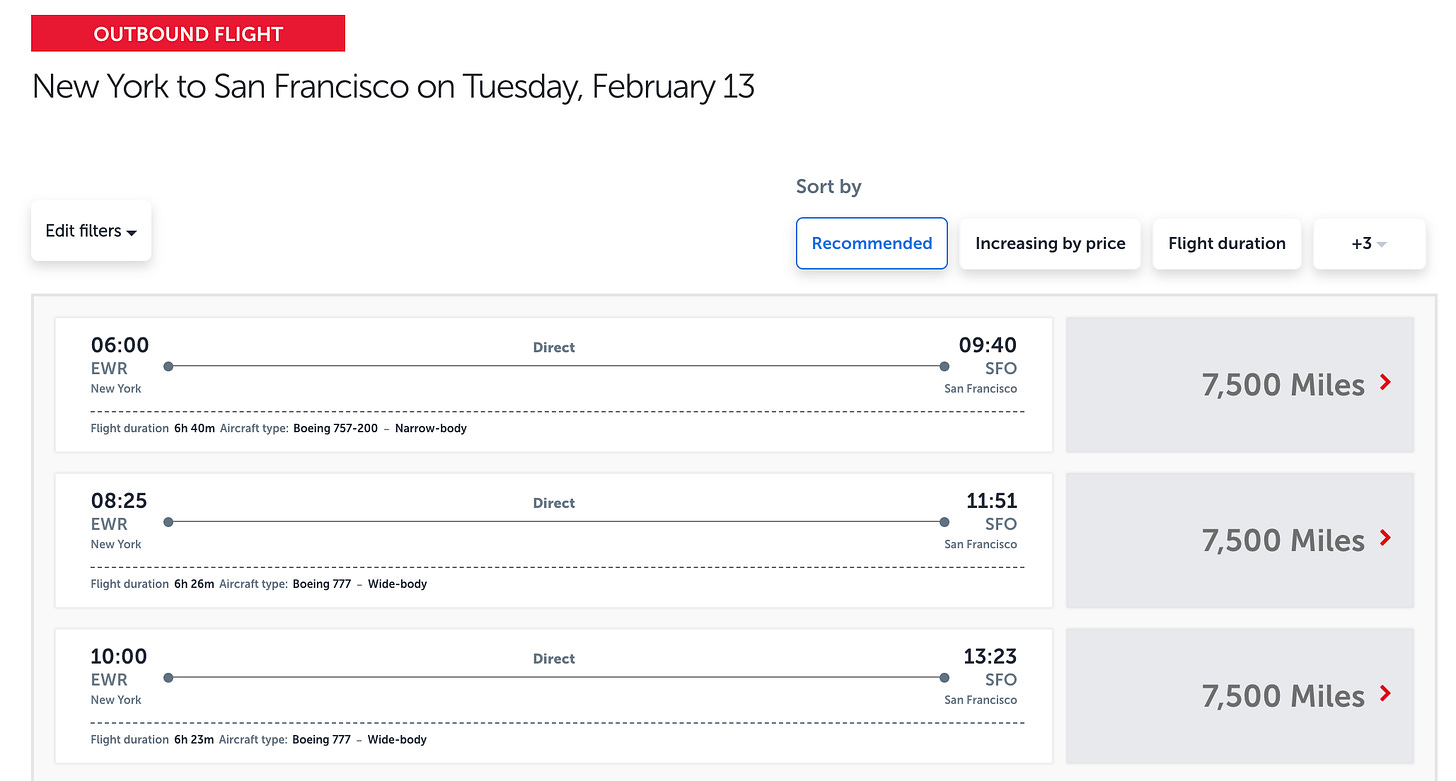

Now that we’ve identified a date that has partner saver space, we can head back to Turkish and search there:

And voila! We found Turkish partner saver space for this domestic United flight, and its just 7.5k Turkish miles compared to 12.5k Air Canada miles!

One caveat: before you get too excited about the 12.5k mile domestic business class redemptions, I should say that it’s very very hard to find award availability for this one. I’ve never succeeded on it personally, and if you find it, you might wanna buy a lottery ticket. The economy tickets are usually very doable though.

Air France/KLM Flying Blue for insanely cheap trips to Europe

This one isn’t that underrated, and is actually one of the more popular redemptions for people who are getting started in the points game. It doesn’t hurt that Flying Blue is a transfer partner for each of the Big 5 credit card programs too! The reason I’ve still listed it here is many people tend to consider Flying Blue as just a good way to book Delta awards if you don’t have an Amex, but they’re missing the best part: Flying Blue promo rates.

Every month, Flying Blue releases a new set of cities that they offer promotional pricing on (usually 25% off their regular partner saver rates). As long as you fly between any country in Europe and these cities, you’re eligible for the discounted pricing (while seats last of course). The discounted pricing is in effect for trips within 6 months of the current month, so the January promos are in effect for trips till June 30.

Unfortunately there’s no US-based cities on this list for January, but in December, you could have booked flights from the following cities for a discount:

Washington D.C. to Europe from 15k miles (25% off)

Boston to Europe from 15k miles (25% off)

This month there are lots of Canadian cities on the list though (Toronto, Montreal, Ottowa), so for my Canadian friends out there, it’s your time to shine! You can always see the list of cities here under “Long-Haul Flights” (I suggest bookmarking this link!)

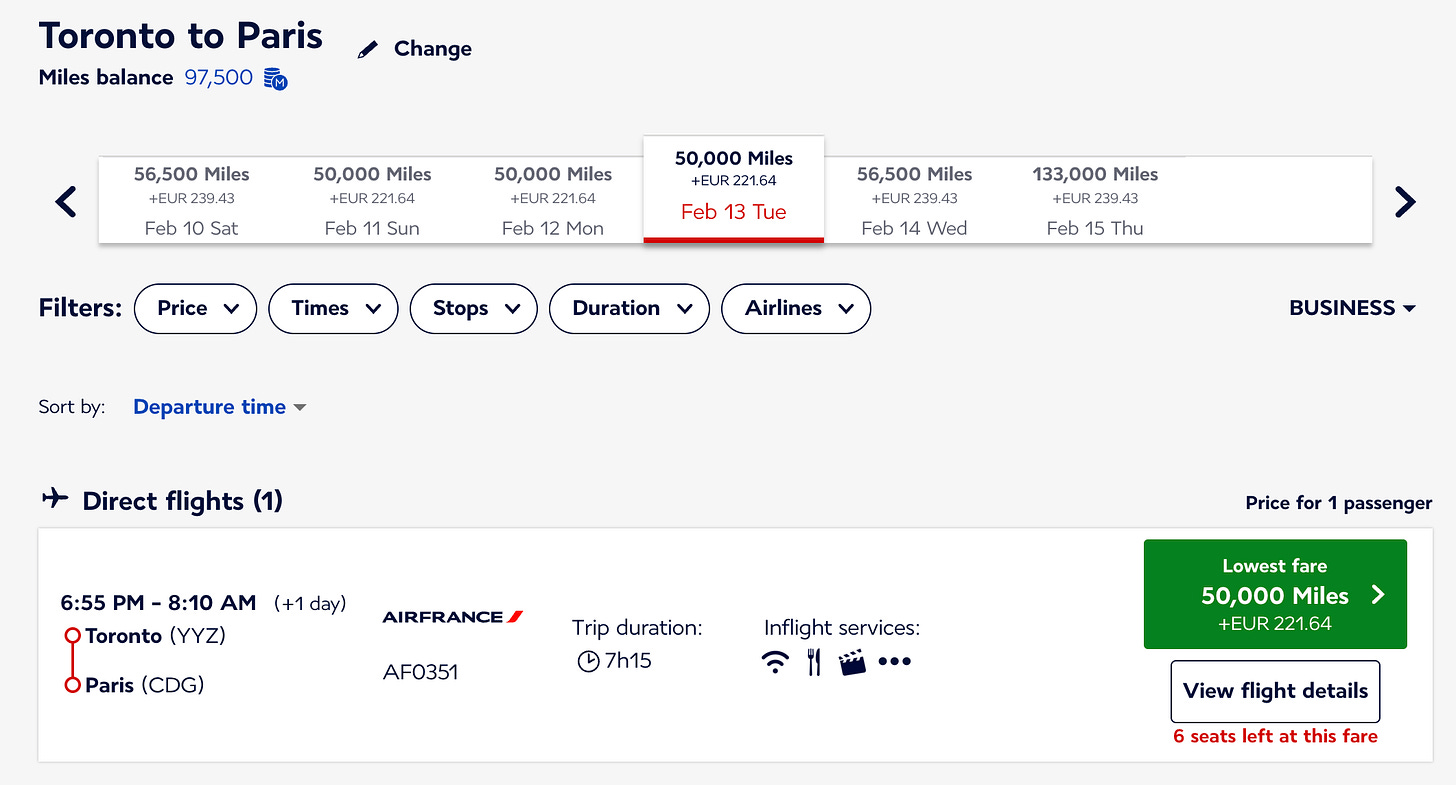

Let’s check out an example. Let’s say you’re looking to do V-Day in the city of love, Paris. We can pop in Toronto for the origin and Paris for the destination, and select Business. Seems there’s some partner saver space for Feb 13! You can tell because the button is in green; non-saver space is shown in blue.

50k ain’t bad for Air France business class! You will need to pay a bit of a higher fee here (220 euros), but this flight is going for $5526 right now, so you’re getting an insane 10.5¢/pt redemption here. What a steal for V-day in Paris.

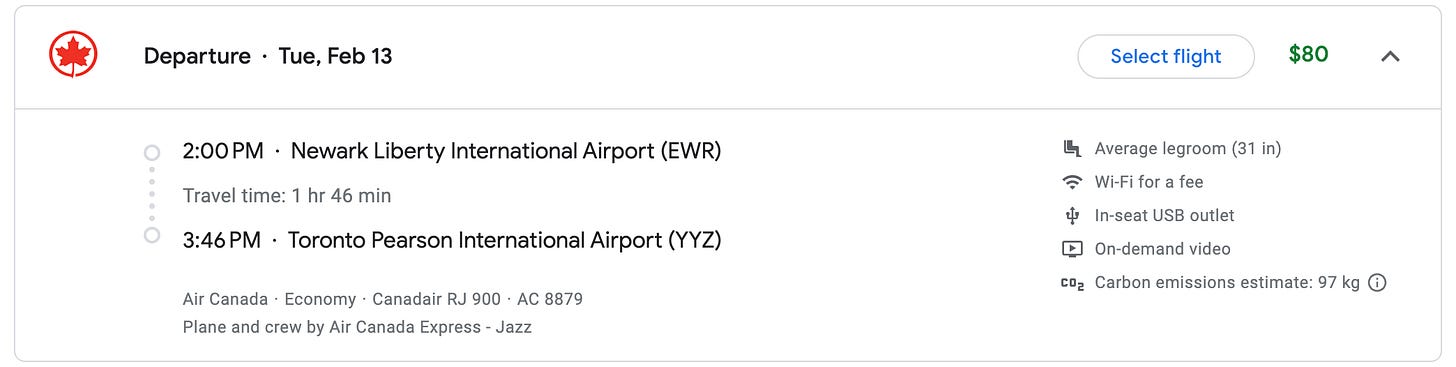

(Pro tip: You don’t have to reside in Toronto to take this flight…there’s dozens of NYC <> YYZ flights every day, and you could just book a cheap one like the one below, chill in the Air Canada lounge for free with your business class ticket, and hop over to Paris from there.)

There’s so many more underrated transfer partners I could include, but this issue is getting kinda long, so I’ll throw ‘em in a future issue!

Deals and Other Awesome Stuff

Bilt Dining has 100 restaurants participating in NYC Restaurant Week! You’ll earn extra Bilt points on these restaurants, even if you don’t use your Bilt card (just make sure to register your other card in the Bilt wallet). Plus you can register any Mastercard here (including your Bilt one) to get $10 in statement credits per restaurant, up to $30. You can check your Bilt app for the full 100 restaurant list.

Chase Offers has a few cool promos running (may vary by card). Be sure to activate them in the Chase app! Here’s a few on the Chase Sapphire Reserve:

10% cash back on Liquid IV and McDonald’s for your next

drunk night outwholesome night in.10% back on various hotel chains, including Intercontinental, Crowne Plaza, Le Meridien, Kimpton, Hyatt Place, and Holiday Inn.

$10 cash back on Turbotax: file your taxes early and feel like a true adult

Since I’m a travel advisor working under a licensed travel agency, I can get you access to perks and rates that aren’t publicly available when you book through me. Virtually all of these options include free perks like buffet breakfast for 2, $100 hotel credit, and room upgrades! Here’s a few of the coolest ones:

Park Hyatt Bangkok: Stay 3 nights, pay for 2 on stays till March 31. Also, stay 2 nights, pay for just 1 for specialty suites (with same perks)

Andaz 5th Avenue (NYC): Stay 4 nights, pay for 3 on stays till March 31 (includes perks like free breakfast, $100 hotel credit, and room upgrade). The Andaz is one of my personal favorite hotels in NY!

Thompson Denver: Stay 3 nights, pay for 2 for stays till March 10. Those of you going for a *cough* certain digital asset conference *cough* might find this one useful! (I’ve stayed there personally too for that same conference in the past)

Grand Hyatt Playa del Carmen Resort: Stay 3 nights, pay for 2 for stays till June 30. Also, you’ll get an extra $50 to spend at the spa (on top of the $100 hotel credit).

If you’re staying at a Kimpton hotel this month or next, say “Chalet All Day” to the front desk. You’ll be glad you did!

Thanks for making it this far and I hope you’re enjoyed this first issue!

It’s my first time doing anything like this, and I’d really appreciate your thoughts and feedback in my Google form here!

Bon Voyage,

Shrey

Looking forward to the next one 👀

Just booked our next trip to Italy on emirates using points. I don’t think we’ve paid for a flight with cash in years!